Why spend thousands of dollars and hours of your time with a lawyer when you can create your estate plan in less than 60 minutes from the comfort of your own home? Give our platform a try and see just how easy and affordable estate planning can be!

Look no further than Net Law's online platform with the smart guide interview process! In 2012, Net law became the only law firm in online estate planning to win the prestigious James Keene award from the American Bar Association. That's something even the big names like Legal Zoom, Rocket Lawyer, Trust & Will, and Nolo still haven't achieved!

For only $600, you can create a comprehensive estate plan (for both spouses) that includes a living trust, children's trust, last will and testament, living will, HIPAA authorization, general power of attorney, medical power of attorney, advance directives, and even a pet trust. Plus, our smart guide interview feature ensures that you get the proper questions and appropriate documents for your specific situation and state laws. Keep your documents safe and in one place in the included Life Vault online cloud storage. Top notch customer service is also available Monday through Friday 8.30 AM to 8.30 PM Eastern Standard Time via a chat bar in your plan.

Net Law is the easiest way to always have an updated Estate Plan!

Save time and money when laws or life circumstances change.

Prefer to listen?

Press play for your convenience.

Discover the simplicity of estate planning with Net Law! The platform is designed for the everyday American family with a straightforward estate. Users can input their details once, respond to a set of lawyer-crafted questions, and Net Law's smart software takes care of the rest. For a cost-effective one-time fee of $600, Net Law provides an inclusive estate plan (covering both spouses) that includes a last will and testament, revocable living trust, children's trust, power of attorney, health care surrogate designation, HIPAA Authorization, living will declaration, and even a pet trust for your furry friends.

The 'smart guide' interview system offered by Net Law provides relevant questions based on each user's unique situation and specific state laws, ensuring accurate coverage of all their needs. This streamlined process ensures that users receive the exact documents they require without any hassle.Furthermore, Net Law offers a reassuring 30-day money-back guarantee*, providing users with total peace of mind, knowing they are receiving the right documents at an affordable price. Welcome to Net Law, where quality estate planning meets affordability and user-friendly technology!

* Limited guarantee not applicable in North Carolina

How the Net Law Plan works

Prefer to listen?

Press play for your convenience.

Welcome to the friendly world of Net Law, your hassle-free online platform for estate planning! Here, we believe that keeping your estate plan up-to-date shouldn't be a luxury, but a simple, affordable necessity. Life is full of changes, isn't it? A new baby, a big move, or maybe a career shift can all call for updates to your will and living trust. And that's not even taking into account the ever-evolving estate laws!

Unfortunately, many families struggle to keep their estate plan current due to time, cost, and legal complexities. Enter Net Law, your ally in seamless estate planning. Our mission is to make updating your estate plan as effortless as possible. Net Law offers a user-friendly platform designed to help the average American family adapt their estate plans to life's many twists and turns, as well as keeping pace with legal changes. We've partnered with experienced attorneys across all 50 states, ensuring your documents are always in line with the latest state laws.

Here's how it works: you prepare your documents on our platform. Say, a year or two down the line, you relocate to a different state. With Net Law, all you have to do is update your address on our platform and your documents will automatically adjust to your new state's laws. No fuss, no additional costs.

Now, consider another scenario. You've prepared your estate plan, but a significant life event—a birth, death, marriage, or divorce—necessitates a change in your documents. No problem! Net Law's intuitive 'smart guide' interview system helps you update your plans quickly and accurately. Just print, witness, notarize, and voila! Your updated estate plan is ready, without the need to pay extra fees or visit an attorney's office. And the best part? All this invaluable peace of mind is yours for a one-time fee of just $600 (plus optional $8 fee after the first year).

After the first year, for an optional $8 per month, you'll continue receiving updates, keeping your plan as current as the morning news. So, why wait for changes or worry about new laws potentially impacting your estate plan? With Net Law, you're always one step ahead, securely managing your estate in a timely and cost-effective way.

While our plan is particularly suitable for average American families with uncomplicated estates, we believe it's a smart choice for anyone keen to save time, money, and avoid unnecessary stress. Take a moment to explore Net Law. It's time to put your future in the right hands, yours!

Do-It-Yourself Estate Planning for Every Family

Is it wise for individuals to handle their own estate planning with Net Law?

Net Law acknowledges that meeting with an attorney for estate planning can often be financially out of reach for most American families, with costs ranging from $3,500 to $7,000 per plan. However, the majority of Americans do have a genuine need for estate planning, as they possess property and loved ones to protect.

Net Law recognizes the importance and benefits of having an estate plan prepared by a competent and specialized attorney, but they also understand the financial sacrifice involved. Furthermore, even if a family does pay for an attorney, it doesn't guarantee their ability to afford to keep the plan up to date amidst life's changes, such as a divorce, a relocation to a new state, or other altering circumstances. This is where Net Law comes into play. Their platform enables families to create an estate plan at a significantly reduced cost.

While it is a do-it-yourself platform, it is not a do-it-by-yourself experience. Net Law has automated the process of meeting with an attorney, which has received recognition for excellence from the American Bar Association. Notably, numerous attorneys across the country utilize their software while meeting with their own clients. Net Law envisions transforming the legal industry by becoming the premier online platform for estate planning services, providing the highest quality legal advice. Over the past several years, estate plans created by Net Law have proven successful in courts throughout the nation since 2012. If their platform determines that a situation would be better handled by an attorney, they can provide a referral.

While attorneys can rightfully justify their fees due to the time and effort required to create an estate plan tailored to each family's unique circumstances, Net Law has invested significant resources to automate the process, saving time and money for American families. An affordable plan like Net Law's holds significant value in today's uncertain times, allowing families to make appropriate preparations without being hindered by cost.

It is important to remember that each passing day without an up-to-date estate plan poses a slight gamble with high stakes. With Net Law, individuals can take control of their future and protect their loved ones in a cost-effective manner.

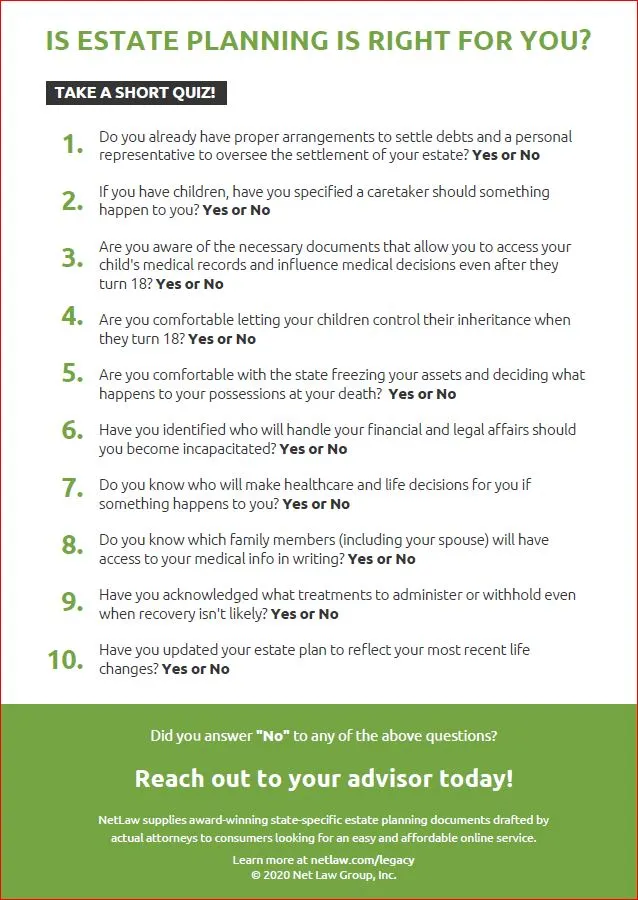

What are the 3 types of advanced planning that every family should have in place for the protection of their family's future?

Will

A will is a legal document that outlines a person's wishes for the distribution of their assets and property after their death. It is a written statement that details how a person wants their property and possessions to be divided among their beneficiaries or heirs. A will can also include instructions for the care of any dependents, such as children or pets, and can appoint guardians or trustees to manage assets for minors or those with special needs. In order for a will to be legally binding, it must meet certain requirements, such as being signed and witnessed in accordance with local laws.

Living Trust

A living trust is a legal document that allows an individual to transfer the ownership of their assets and property into a trust during their lifetime. One of the main benefits of a living trust is that it allows for the avoidance of probate, which is the legal process of distributing a person's assets after their death. Additionally, a living trust can provide privacy for the grantor and their beneficiaries since it does not become a matter of public record like a will does.

Also, available for an additional fee is the Special Needs (or Supplemental Needs) Trust. Ask for details.

Advanced Healthcare Directives

A living will, along with the medical power of attorney, are legal documents that allow individuals to specify their preferences for medical treatment and end-of-life care in the event they become incapacitated and unable to communicate their wishes.

Having a living will can give individuals and their families peace of mind, as it helps to ensure that their wishes are followed even if they cannot communicate them themselves. It can also help to alleviate any potential conflicts or misunderstandings among family members or healthcare providers about the person's wishes for their medical care.

100% Money Back Guarantee

Your payment is 100% secure

Copyright 2023. All Rights Reserved By thrivingwave.com.